“Trump’s Tariffs Trigger Shock Market Crash, $2 Trillion Lost in 25 Seconds”

In a breathtaking turn of events, President Donald Trump’s recent speech led to a dramatic plunge in the stock market, wiping out a staggering $2 trillion in just 25 seconds.

The announcement of new, sweeping tariffs has sent shockwaves through both international markets and American households. The immediate impact on the global economy has been profound, with nations worldwide now bracing for the consequences.

World leaders have expressed deep concern over the scope of these tariffs, which are set to affect not only the US’s trading partners but countries around the globe. The European Union has already hinted at retaliatory measures, adding fuel to an already tense global economic environment.

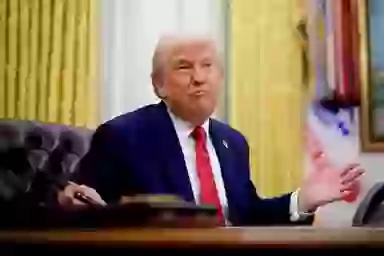

Trump made the controversial announcement on April 2, in a speech from the White House Rose Garden, referring to the day as “Liberation Day.” He emphasized that the tariffs were designed to reduce America’s dependence on foreign goods, sparking both domestic and international alarm over the potential long-term effects.

“Global Markets Shattered as Trump’s Tariffs Trigger $2 Trillion Loss in Minutes”

China, Mexico, Canada, and the European Union have been on the front lines of a fierce trade war with the United States ever since President Donald Trump imposed a 25% tax hike on a wide range of their imported goods.

In a move that has sent shockwaves through the global economy, Trump signed an executive order imposing “catastrophic” tariffs on the US’s major trading partners, and the stock market is already feeling the aftermath.

As the tariffs took effect, the world watched in disbelief as global stock markets plunged and the US dollar sank to a six-month low. The sweeping tariffs, targeting as many as 60 countries, have reverberated through financial markets worldwide, causing massive losses across the board.

The S&P 500 alone lost $2 trillion in market capitalization in a matter of seconds after Trump’s announcement of reciprocal tariffs on countries including China, Mexico, and the EU.

Within just 20 seconds of his speech, European markets opened lower, following a sharp selloff in Asia and a steep decline in US futures. In a matter of minutes, the financial landscape had drastically shifted:

- The FTSE 100 in London dropped 1.3%,

- Germany’s DAX fell 1.6%,

- France’s CAC40 dropped 1.8%,

- Japan’s Nikkei and Topix fell by 3.3% and 3.5%, respectively, after Trump imposed a 24% tariff on the country,

- Hong Kong’s Hang Seng dropped 1.9%,

- Vietnam’s stock market plummeted by a staggering 6.7% after being hit with 50% tariffs.

US futures didn’t escape the carnage either. Dow futures lost 2.1%, while S&P 500 futures dropped 3% in the immediate aftermath of the announcement. The global financial landscape has been rocked, leaving many to wonder how the world economy will recover from these swift and far-reaching consequences.

“Markets in Freefall as Trump’s Tariffs Trigger Major Losses: Nasdaq, Apple, and Tesla Suffer Heavy Hits”

The fallout from President Trump’s new tariffs has been swift and severe, with Nasdaq futures plummeting 3.5%. Major tech stocks were hit hard, with Apple falling by 7%, Nike dropping 7.3%, and Nvidia declining by 5.6%. Even Tesla took a hit, losing 8% in the wake of the tariff announcement.

Online, the reactions have been nothing short of explosive. On X, one user wrote: “Not to alarm everyone too much but the U.S. stock market HAS LOST OVER 2 TRILLION in THE LAST TWENTY MINUTES.” Another user vented: “The stock market is tanking because Trump is a stupid piece of s*** that went bankrupt 6 times and is looking to make America #7.” Meanwhile, on Reddit, one person sarcastically noted, “Well, well, who could’ve seen this coming?? Literally everyone.”

Adding to the chaos, the US dollar took a massive hit, falling 1.1% against other currencies, marking a grim day for both the dollar and anyone hoping to invest in it.

According to Adam Hetts, portfolio manager at Janus Henderson Investors, it’s unlikely that the situation will improve anytime soon. He told The Guardian: “Eye-watering tariffs on a country-by-country basis scream ‘negotiation tactic,’ which will keep markets on edge for the foreseeable future. Fortunately, this means there’s substantial room for lower tariffs from here, albeit with a 10% baseline in place.”

He continued, “We’ve seen the administration have a surprisingly high tolerance for market pain, but now the big question is how much tolerance it has for true economic pain as negotiations unfold.”

In the wake of this financial chaos, investors have fled to safer assets, such as gold, which skyrocketed to a record high of $3,167.50 overnight. It’s clear that the economic turbulence is far from over, leaving many to wonder how much longer these market shocks will continue.